This page explains how to use the STP/calculated remuneration template. This template is designed for users with a solid understanding of payroll concepts, including payment types and employment terms.

On this page

- STP/calculated remuneration - how it works

- Column K - Ordinary hours

- Column L - Employee start date

- Column M - Base salary (pro-rata)

- Column N - Base salary (fixed)

- Column O - OTE (pro-rata)

- Column P - OTE (fixed)

- Column Q - Superannuation

- Column R - Allowances

- Column S - Fringe benefits

- Column T - Employee Share Schemes (ESS)

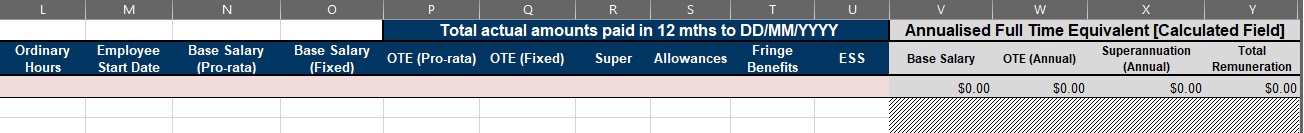

- Columns U - X

The private sector Workplace Profile templates are available for download here.

The Commonwealth public sector Workplace Profile templates are available for download here.

STP/calculated remuneration - how it works

Unlike the Unit Level template, the STP file automatically calculates annualised, full-time equivalent remuneration, so you don’t need to do those calculations manually.

What you need to provide

To enable these automatic calculations, you must enter more detailed information than in the Unit Level template. This information is explained under each Column subheading on this page.

How the calculation works

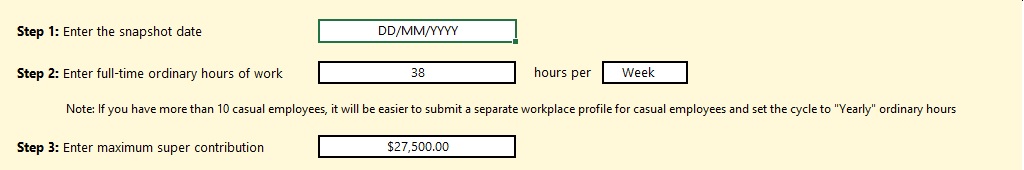

The file compares each employee’s ordinary hours and start date against the information you enter in the ‘Instructions’ tab.

- If the employee’s ordinary hours are less than full-time, their pay will be scaled up to reflect full-time equivalent.

- If the employee’s start date is less than 12 months before the snapshot date, their pay will be scaled up to reflect a full year of work.

Payment reference table - STP/payroll

| Payment type | STP/payroll file |

| Annual leave and leave loading | Base salary (pro-rata) and OTE (pro-rata) |

| Carer and sick leave | Base salary (pro-rata) and OTE (pro-rata) |

| Employer funded parental leave | Base salary (pro-rata) and OTE (pro-rata) |

| Penalty rates and shift loadings (paid as part of a casual, permanent or fixed-term employee’s ordinary working hours) | Base salary (pro-rata) and OTE (pro-rata) |

| Salary sacrificed items | Base salary (pro-rata) and OTE (pro-rata) |

| Wages/salary (fixed) | Base salary (fixed) and OTE (fixed) |

| Wages/salary (pro-rata) | Base salary (pro-rata) and OTE (pro-rata) |

| Workers’ compensation payments | Base salary (pro-rata) and OTE (pro-rata) |

| Allowances (fixed amount) | Allowances |

| Allowances (pro-rata) | If attracts super = OTE (pro-rata) If no super = Allowances |

| Associated payments on overtime earnings (penalty rates) | Allowances |

| Back pay or lump sums | OTE (fixed) |

| Bonuses (pro-rata) | If attracts super = OTE (pro-rata) If no super = Allowances |

| Bonuses (fixed) | If attracts super = OTE (fixed) If no super = Allowances |

| Cashed out annual leave or long service leave | OTE (pro-rata) |

| Car payments (company car) | Allowances |

| Car reimbursements (personal car) | Fringe Benefits |

| Car allowance | Allowances |

| Discretionary payments (fixed) | If attracts super = OTE (fixed) If no super = Allowances |

| Overtime worked outside of expected hours | Allowances |

| Sales commission (pro-rata) | OTE (pro-rata) |

| Sales commission (fixed) | OTE (fixed) |

| Share allocations | ESS |

| Superannuation | Superannuation |

| Superannuation on fixed remuneration | Superannuation |

| Temporary performance loading or higher duties allowance | OTE (pro-rata) |

Column K - Ordinary hours

‘Ordinary hours’ are a mandatory field, they refer to an employee's normal and regular hours of work, which do not attract overtime rates. You are required to enter ordinary hours in two different places:

- The 'Instructions' tab – you must enter the ordinary hours figure and the period those hours relate to that is considered full-time for the employees on the worksheet.

E.g. 38 hours per week, 76 hours per fortnight etc

- The Upload tab – you must enter the ordinary hours for each employee as it relates to the standard your entered in the 'Instructions' tab

E.g. A full-time employee will have the exact same ordinary hours figure as what is in the Explanation tab, a 0.5 FTE employee will have ordinary hours that are exactly half the 'Instructions' tab figure.

What if certain employees work different ordinary hours?

In the case that you have more than one full-time standard (e.g. some employees work to 38 hours per week as full-time, others work to 40 hours per week) we recommend you complete separate files for each full-time standard.

Please note - If you complete separate Payroll-Aligned Workplace Profiles for one legal entity you must upload them together as a batch when completing your report in the employer portal.

What about casual employees?

Casual employees who work irregular hours can be put onto their own template which is set to a 'yearly' full-time standard, this will enable you to enter the exact number of hours they have worked.

- Enter the number of hours considered full-time for an entire year for your workplace in the 'Explanation' tab and select ‘year’ as the period.

- For each casual employee enter the actual number of hours they worked in that year in the Upload tab

Use a separate worksheet if you are having issues putting casual employees onto a template that is set to a weekly or fortnightly full-time ordinary hours standard.

Why do I need to provide ordinary hours?

Providing ordinary hours is mandatory because it enables the spreadsheet to automatically calculate amounts that had been paid on a pro-rata basis to a full-time standard for employees who are not full-time.

- A full-time equivalence ratio (FTE) is estimated for each employee by dividing their ordinary hours in the Upload tab by the full-time ordinary hours on the 'Explanation' tab.

- The pro-rata amounts are then divided by the FTE to estimate what each employee would have been paid if they were working the full-time ordinary hours.

- If an employee commenced work within the last 12 months up to the snapshot date, the FTE is adjusted for their length of service up to the snapshot date.

The amounts are annualised to permit salaries and remuneration to be analysed consistently, without hours worked and length of service becoming confounding factors.

Column L - Employee start date

‘Employee start date’ is a mandatory field. It refers to the date that each employee commenced employment with the organisation and should be entered in the date format: DD/MM/YYYY.

- The ‘Employee start date’ should be less than or equal to the snapshot date chosen for your Workplace Profile.

- Employees that commenced working after the nominated snapshot date or who have ceased employment before the nominated snapshot date must not be included.

Why do I need to provide an employee start date?

Providing a start date is mandatory for this type of Workplace Profile because it enables the spreadsheet to automatically calculate amounts that had been paid on a pro-rata basis to a full-year equivalent for employees who did not work the full year.

- The template compares an employee’s start date to the snapshot date you have entered on the 'Instructions' tab.

- If the employee has not been employed for 12 months or more, the template calculates their pro-rata amounts up to be equivalent to working the full 12 months.

This data is important for calculating annualised salary and remuneration amounts for the part-year employees or those with extended periods of unpaid leave.

Accounting for unpaid leave in the STP/Payroll template

Unpaid leave can be accounted for in this file by treating the employee as a part-year employee.

- Determine the length of time that the employee has been on unpaid leave in the 12-month period up to your snapshot date.

- If the employee worked the full year (apart from the period of unpaid leave) – change the start date of this employee to 12 months before the snapshot date and then add on the period of unpaid leave to adjust the start date.

- If the employee did not work the full year (apart from the period of unpaid leave) – change the start date of this employee to be when they started and then add on the period of unpaid leave.

For example – an employee with 2 weeks of unpaid leave on a file that has a snapshot date of 31/03/2024:

- If the employee worked the full year – change start date to 01/04/2023 and then add on two weeks for 14/04/2023.

The template will recognise the employee was not being paid for 2 weeks out of the 12-month period and then adjust their income up slightly.

Column M - Base salary (pro-rata)

‘Base Salary (pro-rata)’ is a mandatory field. It refers to an employee’s annual salary or wage payments before tax, including salary sacrificed items, as received by the employee. Do not annualise the amount as this will be automatically done by the Workplace Profile template.

Base Salary (pro-rata) are payments made for (or that supplement) ordinary hours that are based on time worked, it includes:

- Regular wage or salary payments

- Annual leave/leave loading

- Carer and sick leave (paid)

- Employer funded parental leave

- Penalty rates and shift loadings

- Workers’ compensation payments

Base Salary, pro-rata or fixed, is not an employees agreed salary package. You must enter the actual amounts of the items listed above into the employee’s Base Salary (pro-rata) column.

Column N - Base salary (fixed)

'Base Salary (fixed)' is a mandatory field. It refers to Base Salary payments made to an employee regardless of the number of hours they work (as determined by their status as full-time, part-time, or casual employees) or the quality of their performance. Rather, it is a fixed amount, for example, per product produced or per quarter as stipend.

- Wages and salary that are not paid on a pro-rata basis.

Example – A carpenter who is not paid their wage or salary per hour but instead paid per job or paid per product – this is a Base Salary (fixed) payment as it made regardless of the time they have worked.

If you do not pay any Base Salary of a fixed nature for your employee(s), populate this cell with '0'

- You must enter the Base Salary (fixed) amount that has been paid to the employee for the past 12 months up to the snapshot date.

- Amounts recorded in the Base Salary (fixed) column will not be annualised to what a full-time employee would be paid for the past 12 months as they are fixed/one-off payments.

Column O - OTE (pro-rata)

Ordinary Time Earnings (OTE) relates to payments made to an employee for their ordinary hours of work. OTE (pro-rata) is a mandatory column, it includes a range of payments, including:

- Your entire base salary (pro-rata) amount

- Over-award payments

- Certain bonuses

- Commissions

- Shift-loading

- Certain allowances.

In short, the ATO advise that OTE payments are those used to calculate superannuation contributions. This means, if your organisation pays superannuation on a particular payment, it should be included as part of OTE. The ATO provide a good overview of what is (and is not) included in Ordinary Time Earnings.

- OTE does not include superannuation itself, but rather are the payments made on which super contributions are calculated.

- OTE (pro-rata) must exceed or be equal to the Base Salary (pro-rata) amount as it includes 100% of the Base Salary (pro-rata) figure.

Column P - OTE (fixed)

'Ordinary Time Earnings (fixed)' is a mandatory field. It refers to OTE amounts that were fixed in nature (i.e. a defined sum that was not pro-rata). For example, amounts paid to employees per product made or per engagement, or as a fixed amount, regardless of whether they were full-time, part-time or casual.

- Your entire Base Salary (fixed) amount

- Back pay or lump sum amounts

- Fixed/one-off discretionary payments that attract super

- Sales commission (fixed)

If you do not have any of the above payments to record for your employee(s), populate this cell with '0'.

- You must enter the OTE (fixed) amount that has been paid to the employee for the past 12 months up to the snapshot date.

- Amounts recorded in the OTE (fixed) column will not be annualised to what a full-time employee would be paid for the past 12 months as they are fixed/one-off payments.

- OTE (fixed) must exceed or be equal to the Base Salary (fixed) amount as it includes 100% of the Base Salary (fixed) figure.

Column Q - Superannuation

'Super' is a mandatory field. It refers to the superannuation payment to employees’ regulated superannuation fund for their retirement. By law, an employer must pay part of an employee’s earnings into this fund. See ATO definition - Superannuation.

- Super should reflect the total superannuation paid to the employee for the preceding 12 months up to the chosen snapshot date.

- The amount is provided before any salary sacrificing, and pre-tax.

Column R - Allowances

Allowances is a mandatory field. It refers to pro-rata and fixed payments that are not included in Ordinary Time Earnings. Examples include:

- Overtime and any additional payments (such as bonuses) that relate to the overtime

- Qualifications or special duties - for example, first aid certificate or safety officer

- Expense allowances that are expected to be fully expended

- Company car payments

- Car allowance.

Allowances that attract superannuation as part of the employee’s Ordinary Time Earnings should be classified in the OTE (pro-rata) column.

- Enter the 'Allowances' amount that have been paid to the employee for the past 12 months up to the snapshot date.

- Amounts recorded in the 'Allowances' column will not be annualised and will be added to the Total Remuneration unadjusted.

Column S - Fringe benefits

‘Fringe benefits' is a mandatory field. It refers to payments made to employees that are in a different form than salaries or wages. If the employee did not receive a fringe benefit amount you must enter ‘0’ for this cell.

- Enter the fringe benefits amount paid to the employee for the 12 months leading up to the snapshot date.

- Amounts recorded in the ‘Fringe benefits’ column will not be annualised and will be added to the total remuneration unadjusted.

| Include | Do not include |

|

|

For more information on what is considered a fringe benefit, please see the ATO’s definitions.

Column T - Employee Share Schemes (ESS)

'Employee Share Schemes (ESS)’ is a mandatory field. It refers to ESS interests that may be paid to employees or their associates under an ESS. If no ESS payments were made, you should enter ‘0’ into this cell for each employee.

An ESS interest is either:

- A beneficial interest in a share of a company

- A right to acquire a beneficial interest in a share of a company.

The interests can be shares, stapled securities, or rights (including options) to acquire shares or stapled securities.

- Only vested shares are to be included in total remuneration. If you have chosen to report salary data based on the financial year that ends within the reporting period, instead use the value from the Employee Share Statement.

- ESS should be calculated the vested income received by the employee from the employee share scheme for the past 12 months up to the snapshot date.

- Amounts recorded in the 'Employee Share Schemes (ESS)' column will not be annualised and will be added to the total remuneration unadjusted.

Columns U - X

These columns do not require any manual input. Columns U-X will automatically calculate with the total figures based on the data input in columns K-T.

Please review the final figures for Base Salary (column U) and Total Remuneration (column X), as these should reflect the annualised full time, full year equivalent for each employee, and will be used to calculate your organisations gender pay gap.

These fields cannot be manually input.

If you wish to have total control over the final figures for Base Salary and Total Remuneration, please use the Unit Level Template.