The Workplace Profile (WPP) is an Excel worksheet designed to collect information about workforce composition, base salaries, and total remuneration.

It provides a snapshot of an employer’s workforce from within the 12-month reporting period. This is not a total or average headcount number, but an actual count of all the employees who were employed as at your snapshot date.

Snapshot date

The Workplace Profile provides a snapshot of your organisation’s workforce on any one date during a program's 12-month reporting period.

You are free to choose any snapshot date within the reporting period for the submission of your Workplace Profile.

- we recommend that you try and keep the same snapshot date for your Workplace Profile year-to-year as this ensures your data and insights are taken at regular intervals.

- all employees reported in a single template must have their data prepared using the same snapshot date.

For Commonwealth public sector employers using APSC data transfer, we recommend choosing 31 December as your snapshot date to match the APSC data transfer.

Choosing a snapshot date

What snapshot date should I choose? - Private sector reporting

You can choose any date during the reporting period to complete your Workplace Profile. However, please note that the Questionnaire and Workforce Management Statistics must always relate to the full 12-month reporting period (ending 31 March of the year the report is due).

- the most common date chosen is 31 March as this means your entire submission relates to the same 12-month reporting period

- you can choose a date which is representative of your organisation’s normal workforce (for example - if your organisation has seasonal highs and lows).

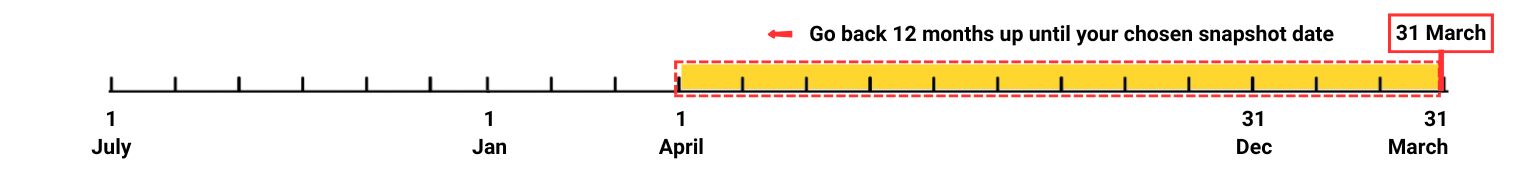

Recommended 31 March snapshot date:

For the employees populated into the Workplace Profile you must identify the salary and remuneration paid to relevant employees in the 12 months before the chosen snapshot date.

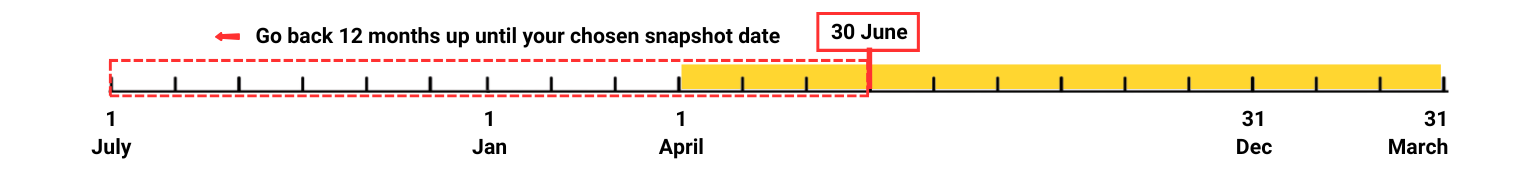

Example of an employer choosing June 30 as their snapshot date:

- In this example the Workplace Profile would be populated with employees who were employed as at June 30

- For either template, you will need to identify the salary and remuneration in the 12 months before the chosen snapshot date (in this example, 1 July to 30 June).

In the Unit Level template, you must use the actual earnings of your organisation’s employees and calculate each to an annualised full-time equivalent amount, you then enter the final calculated amount into two columns (Base Salary and Total Remuneration).

In the STP/payroll template you must enter the actual earnings of your organisation’s employees into each payment column (along with the employee’s ordinary hours and start date) for the template to calculate each amount to an annualised full-time equivalent standard.

The Unit Level template and STP/payroll template are available for download here.

What snapshot date should I choose? - Public sector reporting

You can choose any date during the reporting period to complete your Workplace Profile. However, please note that the Questionnaire and Workforce Management Statistics must always relate to the full 12-month reporting period (ending 31 December of the previous year the report is due).

For Commonwealth public sector employers using APSC data transfer, we recommend choosing 31 December as your snapshot date to match the APSC data transfer.

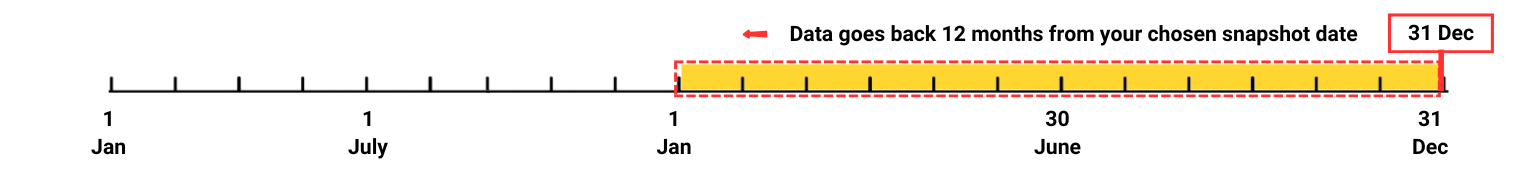

For the employees populated into the Workplace Profile, you must identify the salary and remuneration paid to relevant employees in the 12 months before the chosen snapshot date.

- the most common date chosen is 31 December as this means your entire submission relates to the same 12-month reporting period, and it will match the data transferred from the APSC.

- you can choose a date which is representative of your organisation’s normal workforce (for example - if your organisation has seasonal highs and lows).

Recommended 31 December snapshot date:

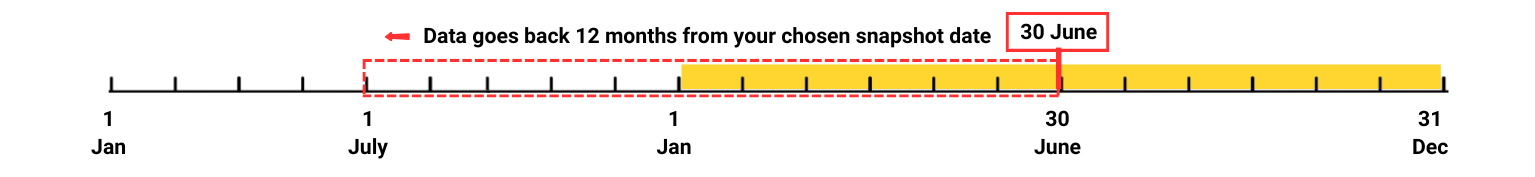

Example of an employer choosing 30 June as their snapshot date:

- In this example the Workplace Profile would be populated with employees who were employed as at June 30

- For either template, you will need to identify the salary and remuneration in the 12 months before the chosen snapshot date (in this example, 1 July to 30 June).

In the Unit Level template, you must use the actual earnings of your organisation’s employees and calculate each to an annualised full-time equivalent amount, you then enter the final calculated amount into two columns (Base Salary and Total Remuneration).

In the STP/payroll template you must enter the actual earnings of your organisation’s employees into each payment column (along with the employee’s ordinary hours and start date) for the template to calculate each amount to an annualised full-time equivalent standard.

The Unit Level template and STP/payroll template are available for download here.

Which employees do I report data for?

Commonwealth public sector employers

All Commonwealth public sector employers using APSC data transfer must upload a Workplace Profile (WPP), and only include:

- CEOs - base salary and total remuneration.

- Casual employees - annualised salary data (yearly pay).

- Any additional APS employees not included in APSED.

For Private sector employers, and Commonwealth public sector employers not using APSC data transfer, your Workplace Profile must include any of the following types of employees who were employed as at your snapshot date:

- all employees who were employed by your organisation on the snapshot date, even if they have since left the organisation

- all employees who work for you in Australia, regardless of whether they are Australian citizens or not

- foreign nationals or expatriates working in Australia, including those with global responsibilities, if the Australian organisation is their employer

- employees who have worked overseas for less than six months in a reporting period

- employees on parental leave (paid or unpaid) or on extended leave

- partners who hold an employment contract (who are reported as per their employed position only)

- casual or seasonal workers

- trainees

- apprentices and graduates.

Do not include:

- an employee who resigned or was terminated/dismissed before the snapshot date

- an employee who was hired after the snapshot date

- governing body members or directors who do not hold an employment contract - if they do, they must be reported as per their employed position with no reference to any income received as per their governing body duties.

- employees from your overseas offices working in Australia but the overseas organisation is their employer

- employees who have worked overseas for more than six months of the reporting period

- equity partners who do not receive a salary, other than the managing partner

- independent contractors

- employees of a labour hire company who have been assigned to work in your business

- volunteers or unpaid visitors.

Do I report every employee employed in the 12-month period?

It is not intended that you populate the Workplace Profile with every employee who was employed by your organisation/group during the 12-month reporting period. Rather, it is a snapshot of your organisation’s employees taken from one day (which falls within the reporting period) with salary and remuneration calculated to a full-time equivalent and annualised standard.

Specific organisation rules

Some organisations have more complex rules for who is or who is not an employer. Below are rules for specific organisations:

Rules for specific organisation types

| Organisation | Rules |

| Recruitment Agency | People who do temporary work through a recruitment agency (also called ‘temps’ or ‘on-hire’ employees) are employees for the recruitment agency, not the host employer.

The recruitment agency must include all workers in its workplace profile. The host employer should not include them. |

| Group training employer | If an apprentice or trainee is directly employed by a group training organisation, that organisation must include them in its workplace profile. The employer they have been placed in should not include them.

You must report if an employee is an apprentice. A trainee is not an apprentice and should be classified under one of the occupational categories for non-managers. |

| Partnership | A partnership’s data must be included in the following:

|

| Religious institution or church | Ministers or officers of religion can be engaged under a contract of employment (Ermogenous v Greek Orthodox Community of SA Inc (2002) HCA 8).

If the answer to the above questions is the church, it is likely that the minister or officer counts as an employee. |

What if my CEO or equivalent is based overseas or employed outside of our group?

Almost all employers reporting data will have a CEO or equivalent who is employed by one of the ABNs being reported in the submission, there are some examples where this may not be the case.

- If a profile template is uploaded without a CEO or HOB (head of business) a data quality warning will display - you will be required to enter a reason why no leadership was reported.

Accepted reasons for not reporting a CEO/equivalent include:

- When the CEO/equivalent is employed by a global entity outside of Australia and not employed by an onshore ABN

- The CEO/equivalent was reported in a different submission group

- The CEO/equivalent is employed by a separate organisation that does form a legal corporate group with the ABN(s) being reported in the submission

The templates

Please refer to Reporting changes for 2024-25 for updates to the workplace profile

You have a choice of two different file formats to submit your organisation’s Workplace Profile data – the Unit Level template, and the STP template (Also referred to as the Payroll-Aligned template). Only one type of workplace profile should be used for your submission.

Each template includes an Instructions tab that includes an explanation of each data column. The information in the Instructions tab should be read before you prepare and populate data into your workplace profile.

Which file should you choose?

We strongly recommend that you use the Unit level file in the first instance. If you are unsure, you can test putting 5-10 employees in both files to determine your preference.

When preparing data using the Unit level file:

This is the default file that is suitable for all users and contains the least amount of data entry.

- Users generally encounter fewer data entry and quality issues as there is less data entry required overall.

- You have control over the final salary/remuneration figures as they are final figures provided by you and not automatically calculated from the information on the file.

- As you are doing your own calculation you can account for unpaid leave or irregular working hours whereas the STP file will require you to adjust certain fields to ensure that the automatic calculation factors in periods of unpaid leave or irregular hours.

- You will only need to provide two figures for each employee – their annualised, full-time equivalent base salary and total remuneration amount.

Notes for the Unit Level template

- Base salary amounts represent the payments for ordinary work (wages, salary payments), total remuneration represents the entire sum of payments made to an employee.

- You must enter the base salary and total remuneration for each employee expressed as their annualised and full-time equivalent earnings.

- You must use the actual earnings for each employee for the 12 months prior to your snapshot date as the basis for this calculation.

The private sector Workplace Profile templates are available for download here.

The Commonwealth public sector Workplace Profile templates are available for download here.

When preparing data using the STP/payroll file:

This file is designed for payroll or finance specialists and requires you to provide the actual amounts paid to employees, split up into component parts (and whether the payment was pro-rata or a fixed amount).

- Preparation requires an advanced knowledge of payment information, types, and terms.

- You need to split up all payments made to the employee into their component parts, and by whether they were paid on a fixed/one off or pro-rata basis.

- You need to provide additional data relating to the employees’ ordinary hours and start date, as well as information on what are the full-time ordinary hours and snapshot date.

- The file uses the payments split up into component parts, and the additional information, to calculate any pro-rata payment up to the full year/full-time equivalent amounts.

- You can choose the full-time ordinary hours of work the STP file calculates to– e.g. 38 hours/week, 76 hours/fortnight etc. If your workplace has multiple ‘full time standards’ for different workforces, you must submit separate files for each cohort.

- For casual employees and employees who have changed their hours in the 12-month period (e.g. full-time to part-time) you can choose full-time ordinary hours of work based on Yearly hours e.g. 1976 hours/Year.

Notes for the STP/Payroll template

- If an organisation has groups of employees that work different full-time ordinary hours (such as your casual cohort), the organisation should upload a separate Workplace Profile for each group. This will ensure all remuneration is correctly converted to annualised, full-time equivalent amounts.

- You must enter the actual earnings of the employee in each category, the template uses the employees start date and ordinary hours figure to calculate their earnings into a full year/full time equivalent amounts.

The private sector Workplace Profile templates are available for download here.

The Commonwealth public sector Workplace Profile templates are available for download here.

CEO or equivalent salary and remuneration

Submissions made from 2024 onwards require employers to provide the base salary and total remuneration amounts for their CEO/equivalent.

- prior to 2024, providing the CEO/equivalents remuneration was voluntary

- if provided, it was not used for the gender pay gap calculation

- going forward it is mandatory and will be included in the gender pay gap calculations

There are a number of scenarios where a CEO or equivalent may not be onshore and/or paid a salary. See below for guidance on how to report salary and remuneration for the CEO or equivalent.

Guidance on reporting total remuneration amount for a CEO/equivalent

| Scenario | Approach | Impact |

| The CEO/equivalent is not paid a salary - e.g. managing partners or owner/operators | The CEO/equivalent will be paid or will draw an income or value for their work. This income is treated as their salary and remuneration.

|

|

| The CEO/equivalent is paid a small amount - e.g. they are paid in stipends or other small amounts. | If this is the income for the CEO/equivalent, this is what will be reported in the profile.

|

|

| The CEO is based overseas and may be paid in foreign income - e.g. globally based head offices where there is no onshore CEO/equivalent. |

|

|

| The CEO is based onshore for 6 or more months and is paid in a foreign income. |

The exchange rate used for this conversion can either be the current date, the date of the end of the reporting period, or the date the payment(s) were made. |

|

| The CEO/equivalent is directly employed by another company that is wholly and legally separate - i.e. the CEO is employed by another entity that does not form a corporate group with the organisation(s) being reported. | If the CEO/equivalent is not directly employed by any entity in the corporate group:

|

|

This table will be updated if WGEA is made aware of any other scenarios, please send an email to support@wgea.gov.au if you require advice.

Entering pay information

Below is an overview of different types of payments and where they are categorised in each Workplace Profile template. Please refer to the guide information regarding each column for definitions and guidance based on which file you are completing.

Notes for the Unit Level template

- Base salary amounts represent the payments for ordinary work (wages, salary payments), total remuneration represents the entire sum of payments made to an employee.

- You must enter the base salary and total remuneration for each employee expressed as their annualised and full-time equivalent earnings.

- You must use the actual earnings for each employee for the 12 months prior to your snapshot date as the basis for this calculation.

Notes for the STP/Payroll template

- If an organisation has groups of employees that work different full-time ordinary hours (such as your casual cohort), the organisation should upload a separate Workplace Profile for each group. This will ensure all remuneration is correctly converted to annualised, full-time equivalent amounts.

- You must enter the actual earnings of the employee in each category, the template uses the employees start date and ordinary hours figure to calculate their earnings into a full year/full time equivalent amounts.

Where does this payment go?

Refer to the below table for a quick reference of where each type of payment is allocated in both file types.

Table of payment types

| Payment type | Unit level file | STP/payroll file |

| Annual leave and leave loading | Base salary* | Base salary (pro-rata) and OTE (pro-rata) |

| Carer and sick leave | Base salary* | Base salary (pro-rata) and OTE (pro-rata) |

| Employer funded parental leave | Base salary* | Base salary (pro-rata) and OTE (pro-rata) |

| Penalty rates and shift loadings | Base salary* | Base salary (pro-rata) and OTE (pro-rata) |

| Salary sacrificed items | Base salary* | Base salary (pro-rata) and OTE (pro-rata) |

| Wages/salary (fixed) | Base salary* | Base salary (fixed) and OTE (fixed) |

| Wages/salary (pro-rata) | Base salary* | Base salary (pro-rata) and OTE (pro-rata) |

| Workers’ compensation payments | Base salary* | Base salary (pro-rata) and OTE (pro-rata) |

| Allowances (fixed amount) | Total remuneration | Allowances |

| Allowances (pro-rata) | Total remuneration | If attracts super = OTE (pro-rata) If no super = Allowances |

| Associated payments on overtime earnings (bonuses, penalty rates) | Total remuneration | Allowances |

| Back pay or lump sums | Total remuneration | OTE (fixed) |

| Bonuses (pro-rata) | Total remuneration | If it attracts super = OTE (pro-rata) bonus paid pro-rata If no super = Allowances |

| Bonuses (fixed) | Total remuneration | If it attracts super = OTE (fixed, not pro-rated) If no super = Allowances |

| Cashed out annual leave or long service leave | Total remuneration | OTE (pro-rata) |

| Car payments (company car) | Total remuneration | Allowances |

| Car reimbursements (personal car) | Total remuneration | Fringe Benefits |

| Car allowance | Total remuneration | Allowances |

| Discretionary payments (fixed) | Total remuneration | If attracts super = OTE (fixed) If no super = Allowances |

| Fringe benefits | Total remuneration | Fringe Benefits |

| Short and long term incentives | Total remuneration | Fringe Benefits |

| Overtime worked outside of expected hours | Total remuneration | Allowances |

| Sales commission (pro-rata) | Total remuneration | OTE (pro-rata) |

| Sales commission (fixed) | Total remuneration | OTE (fixed) |

| Share allocations | Total remuneration | ESS |

| Superannuation | Total remuneration | Superannuation |

| Superannuation on fixed remuneration | Total remuneration | Superannuation |

| Temporary performance loading or higher duties allowance | Total remuneration | OTE (pro-rata) |

Please note:

- All base salary amounts in the unit level file must be included in the total remuneration figure

- Company car payments - if the car is a tool of trade, it is not included, if the car is part of the employee's salary package it should be included on the profile.

- Reimbursements - reimbursing employees, for work-related expenses, is not employee income and not reported in remuneration. E.g. travel, accommodation, meals, per KM using their own car, work equipment etc.

Employees with no payment information

The data entered into the Workplace Profile for salary and remuneration should be based off what they actually earned in the 12 month reporting period. There are two types of employees who may not have any pay information to be used:

- employees on unpaid leave for 12 months, and

- employees who have started recently but were not yet paid.

If an employee was on unpaid leave for the 12 months of the reporting period or started very recently and had not yet been paid, contractual earnings of the employee can be used instead to forecast a full year/full-time equivalent amount

- Any casual employee with no pay data to report should be omitted from the file.

- Refer to the payment table above to determine where different payments are to be categorised on the profile.

The advice below must only be used if the employee has no payment information for the 12 months being reported. Every other employee must be reported based on the template instructions.

Unit level file

You will need to provide a base salary and total remuneration amount that is based on the employee's contractual rate/figure.

- Provide a base salary amount based on contractual rates/figures that is equivalent to full year and full-time earnings

- Provide a total remuneration amount based on contractual rates/figures that is equivalent to full year and full-time earnings.

STP/Payroll file

This template calculates payments to a full year/full-time standard. If you provide figures which are based on an employees contractual full year/full-time equivalent earnings, you should put an ordinary hours figure that matches what is full-time on the 'instructions' tab, and then put an employee start date which is more than 12 months before your snapshot date.

Example - If an employee is on unpaid leave for 12 months and was contracted to earn 80,000 for full year/full-time work:

- 80,000 is added to Base Salary (pro-rata)

- the same 80,000 is added to OTE (pro-rata)

- Any other contractual amounts are entered (e.g. Super)

- Every empty salary/rem field gets '0'

- The ordinary hours of the employee are what is considered full-time

- The start date of the employee is more than 12 months before the snapshot date chosen

In short - if you have an employee that was on unpaid leave for 12 months, and you provide contractual figures instead - you must ensure that the template does not calculate the payments entered by indicating that this employee was full year/full-time (as this matches the pay info you have entered).